We don’t need to play the prediction game with our finances. We don’t have to aim for “needs”. Financial protection isn’t about needs anyway. It’s about protecting income, assets, and people.

Kyle J Christensen

By Kyle J Christensen, Founder, Principles-Based Planner, Unique Advantage

Unique Advantage Monthly Client Email – July 2024

The biggest difference between Principles-Based Financial Planning and Traditional Financial Planning (the kind that the CFP Board and most other financial planners adopt) is that Principles-Based Planning does not try to predict the future. We fully admit that we can’t actually predict the future, even if we look backwards and try to use the past to forecast the future.

Really smart businesspeople understand why the game of predicting the future is an effort in futility. Take, for example, the thoughts of the former ultra-successful multi-billionaire Jon M. Huntsman, Sr.:

“I am a skeptic when it comes to long-range strategic planning. I smile when young entrepreneurs talk about five-year plans. Any detailed plan covering time frames beyond the next six months is nonsense. One can’t foresee the challenges and opportunities that will arise in the next twelve months, much less in the next five years. Few corporate strategic plans ever work out as expected. If anything, they make companies more bureaucratic and less opportunistic. Business is unpredictable.“

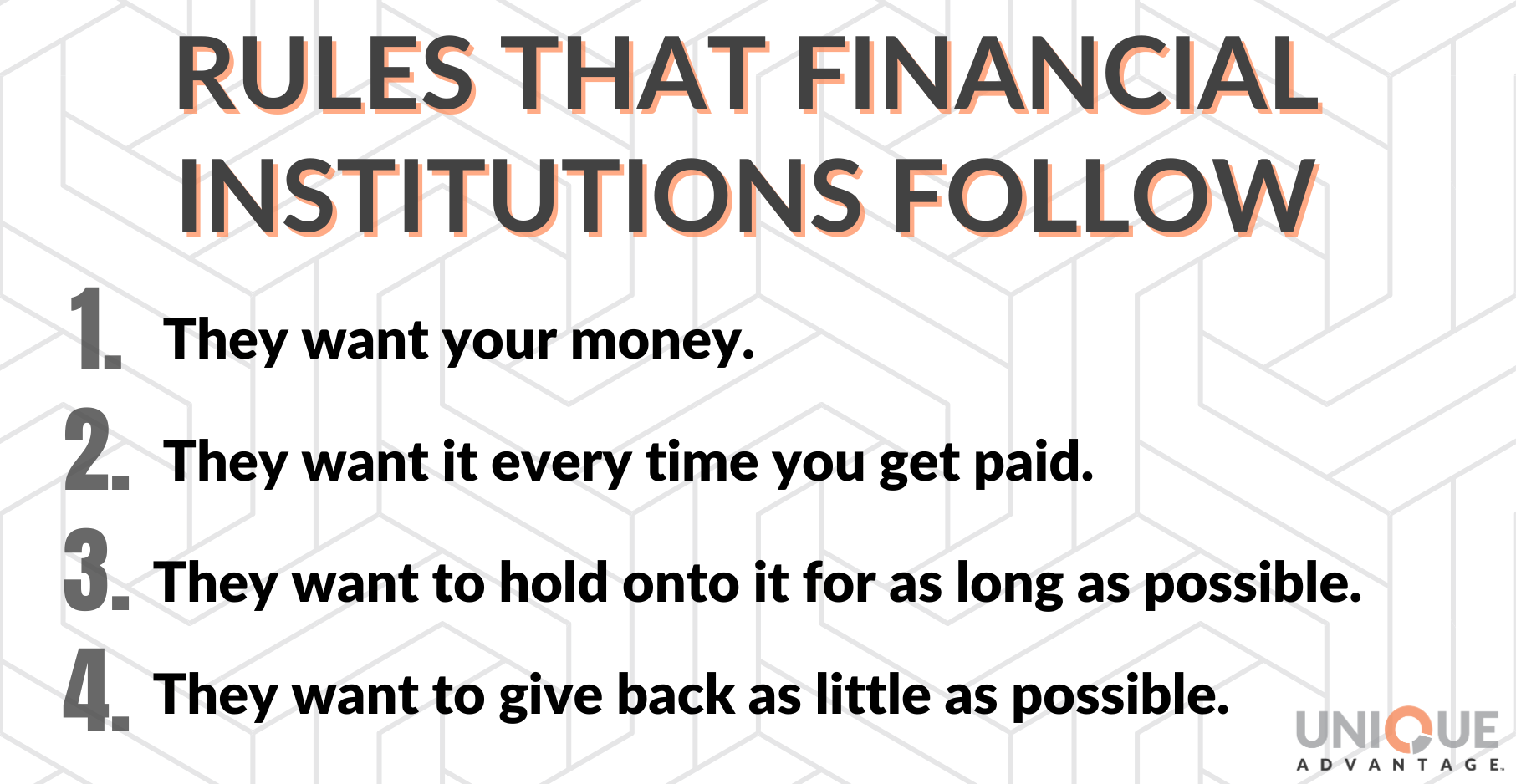

So why is it that the financial planning world, for the most part, has adopted this long-range forecasting approach to financial planning? Well, to understand this, we must refresh our minds about the goals and purposes of financial institutions. These institutions are typically the ones dictating what can and cannot be said in the financial planning arena (especially if we’re talking about individual planners who are securities-licensed).

“The Rules of Financial Institutions” are really just the objectives of financial institutions. They are:

1) They want our money,

2) on a regular and ongoing basis,

3) They want to hold onto it for as long as possible, and

4) They want to give back as little as possible.

These “rules” dictate how all financial institutions approach the topic of financial planning. Robert Kiyosaki emphasizes that their goal “is not, ‘Make our clients rich.’ The game financial planning companies play is ‘assets under management’” (Kiyosaki, Fake, p. 318).

Securities-licensed financial advisors are forced to comply with what the financial institutions want them to say. Did you know that every agency or planning firm with securities-licensed individuals is governed by a “Compliance Officer”? This officer has the authority to regulate all communications that the advisor has with their clients.

Given these constraints, it raises the question: can a securities representative truly act as a “fiduciary,” (providing advice solely in the client’s best interests)?

Clearly financial institutions aren’t concerned about what is actually best for us, nor are they trying to help us achieve financial freedom. What they do want is to sell us stuff. They want assets under management. They want us to send them our money, and they want to hold onto it for as long as possible. Selling based on projected needs is simply a sales technique that is used to help them accomplish the goals of financial institutions. “Only pay for what you need,” is the actual marketing slogan of Liberty Mutual.

Needs means minimum. It doesn’t mean “the best I could have.” It’s the opposite. What you need is generally less than you have. So why would a goal of having less than you have be a worthy financial goal? Why would anyone choose a financial planner who had that as an objective for his/her clients? I would like to note that “needs” (minimization) rarely occurs in the “investment” side of planning. However, it’s almost always applied to the protection side of planning. Again, why would that be good for a client? It’s not. But the needs-based planner is not concerned about what’s best for the client. They are concerned about what’s best for the financial institution (“compliance”).

Let’s talk about some of these “needs-based” questions:

• How much income do I need in retirement?

• How long will I live?

• What rate of return do I need?

• How much money do I need to save each month/year in order to achieve the retirement nest egg I need?

• How much life insurance do I need?

• How much liability insurance do I need?

• How much do I need in savings?

• How much do I need to pay towards my debts?

• When will I die?

• How will I die?

• How much health insurance coverage do I need?

• Will I need long-term care?

• How much will that cost?

• When will I need it?

• How much liability insurance do I need?

• Do I need earthquake coverage?

• Do I need flood insurance?

• Do I need identity theft protection?

If a person doesn’t know what the price of gasoline or a gallon of milk will be next year, what makes us believe that we can actually answer any of those other questions with any real level of certainty? We can’t. That’s proof by itself that the needs-based approach is simply a sales tactic. It’s just one that has been repeated enough times that even the planners and advisors themselves believe they have the capability.

Recently I had a debate with a traditional planner, for a financial webinar series. During one of the segments, the traditional planner took offense at a statement that I was making regarding the principle of Maximum Protection. The needs-based approach was so ingrained in his mind that he couldn’t understand that it was even possible to do “planning” without predicting of future needs. His philosophy: he would encourage his clients to go “middle of the road” on their life insurance (in other words, suggesting that they shouldn’t get their maximum coverage, because that might infringe on their ability to invest more money in the market – which obviously was the planner’s priority). Along with his statement, he suggested that a person needs to have “just enough” to cover their mortgage, pay for their kids’ college, and have a little more to tide the surviving spouse over until they remarry or get a job. “You don’t need your maximum” was the message, loud and clear from the traditional planner’s point of view.

It’s hard to know where to start when addressing the errors in this line of thinking. But I will begin by saying that if the planner that suggests “middle of the road” is wrong, he/she isn’t going to make up any difference (at least, not willingly).

The only way that a person knows if their prediction is right is by looking backwards, and even that is imperfect. For example (I don’t want this to be a political statement, and it truly isn’t, but I realize it may be taken as such), with the recent mass use of the COVID vaccines, can we look back and really tell how effective it was? Those who are proponents of it (especially the politicians and pharma companies that promoted it) will say until they are blue in the face that it was very effective. Those who were/are opposed to it will say until they are blue in the face that it wasn’t. However, unless we could compare to a similar country, with a similar population and demographic, who did not get the vaccine under the same circumstances, we really can’t know for sure how effective the strategy was or was not (at least, empirically). Similarly, we can only know if buying long-term care insurance (for example) was a wise decision by looking back on a person’s life. Did they use it? Did they need it? Was it sufficient? Could they have done something else with the money that would have been even better? Again, it’s imperfect at best, even looking backwards.

We don’t need to play the prediction game with our finances. We don’t have to aim for “needs”. Financial protection isn’t about needs anyway. It’s about protecting income, assets, and people. If your house were to burn down, how would you feel if the insurance company just gave you a smaller house with your basic “needs”? Nobody wants that. I think you would want your entire house rebuilt, along with everything inside.

It has nothing to do with needs. Most people want as much of their income replaced as possible if they were to become too sick or too injured to work. Most people would like to replace as much of their income as possible to their surviving spouse if they knew they were going to die. Most people would want the best liability protection if they were sued due to a serious accident or other liability situation. Investing isn’t about reaching a predicted future need. Most people want as much income as possible from their investment assets, not the least amount that they need to survive.

Our true financial security comes from protecting our entire lifestyle, not just our basic needs. So why should it be any different when it comes to financial planning and protection?

The problem with life is that it is unpredictable. The solution isn’t to try to predict the unpredictable. And that should not be the purpose of financial planning (although most in the planning industry has accepted that as its role). The prediction game is why most financial plans fail! They’re wrong as soon as they’re written.

The purpose of planning is to prepare. It’s to be in the best position you could possibly be in, from a protection standpoint, from an investment-income standpoint. The purpose of planning should be to create a plan that gives you options and opportunity to achieve your best results, regardless of what might happen. The best plan would be one which prepares you for the bad things that could and do happen. And if you have the right plan, and the right principles that you follow, you might even end up in a better position when those negative or unexpected things happen (which would be called Antifragile – ref Nassim Nicholas Taleb’s book, Antifragile).

The aim of a Principles-Based Financial Plan is to be Antifragile.

The solution isn’t predictions, it is principles-based preparedness. To learn more about what this looks like, schedule a time to meet with us: https://uniqueadvantage.biz/schedule-now/