Ultimately, if we could wave a magic wand and choose to have all our income come from [the investor] quadrant, we probably would. The taxation of the income from this quadrant is significantly lower than the others.

Kyle J Christensen

By Kyle J Christensen, Founder, Principles-Based Planner, Unique Advantage

Unique Advantage Monthly Client Email – May 2024

(*Disclaimer: I am not a certified tax accountant or tax attorney. Please seek advice from a qualified professional tax advisor for anything you have questions about related to this article.)

Previously, in Part 1 of this topic, we talked about the first way people can reduce their taxes, which was to Reduce Income. This article will focus on the second way in which people can reduce their taxes.

People can Re-Characterize their income.

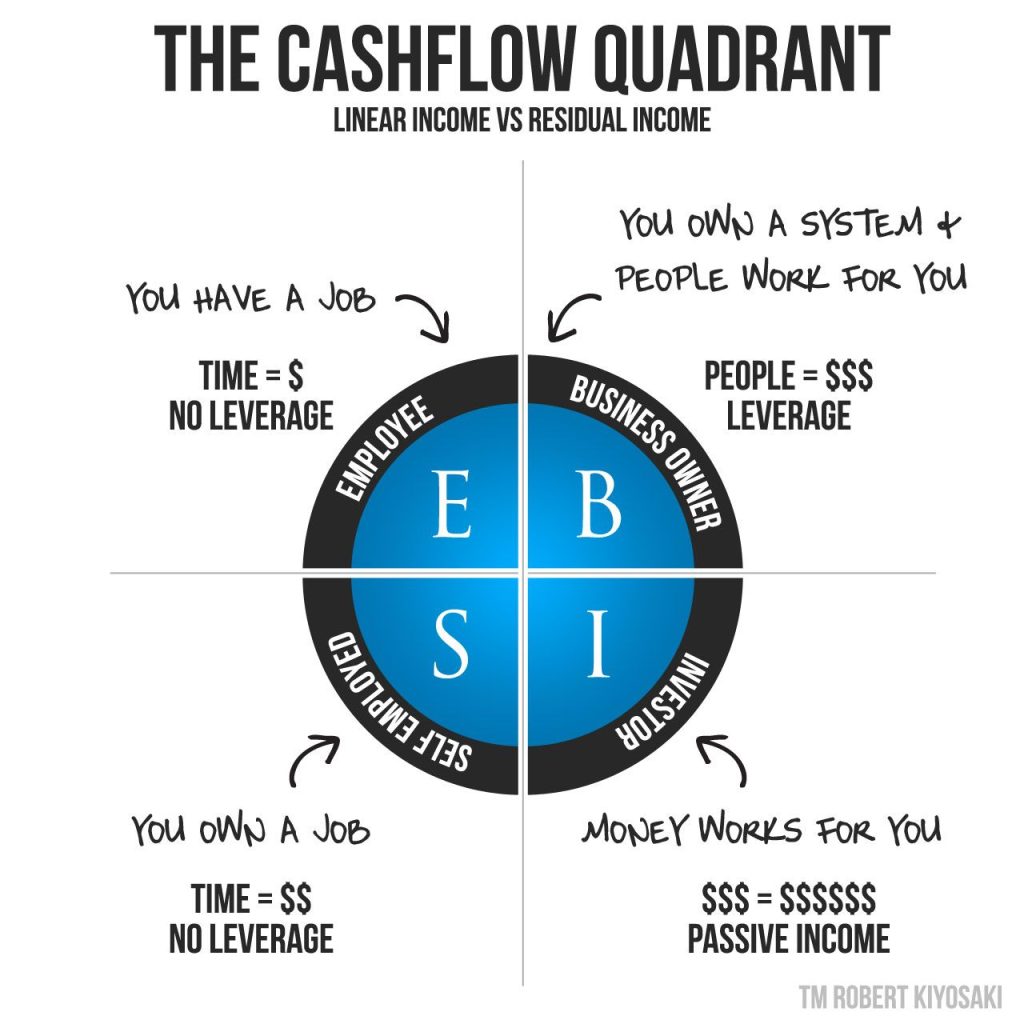

Essentially there are four ways in which a person can receive income. Robert Kiyosaki has a great book that is entirely about this, called Cash Flow Quadrant. The Cash Flow Quadrant breaks up income sources into four areas: Employee, Self-Employed, Business Owner, and Investor. Kiyosaki explains that the rich become rich partially because of how they receive their income. Taxes are the major factor in this.

(source: Rich Dad Fundamentals: The CASHFLOW Quadrant)

The E Quadrant = Employee

When a person is an Employee, they receive W2 income. Their income is subject to two types of taxes, Ordinary Income Taxes and FICA Taxes (FICA taxes are Social Security and Medicare Taxes). The “benefit” of receiving income as an employee (W2) is that the employer pays half of the FICA taxes (FICA = 15.3%). The Social Security portion of the tax is 12.4% and Medicare portion of the tax is 2.9%. The S.S. tax is only applied to earnings up to $168,600 (for 2024). The Medicare tax is applied to all W2 earnings. In other words, if a person makes $1,000,000 as a W2 employee, he/she will receive 1.45% (or $14,500) less than if that same income came from Business profit or investment gains (if self-employed, that number increases to 2.9%, or $29,000).

That may not seem like a big difference, but at an Opportunity Cost of 6% per year, the total Opportunity Cost of paying the extra $14,500 over a 15-year period would be $337,501. In other words, someone who doesn’t have to pay that tax would have another $337,501 in their plan.

When we combine Ordinary Income taxes (both State and Federal), FICA taxes, and the fact that W2 earners cannot write-off nearly as many expenses as a business owner (almost nothing beyond the Standard Deduction, Education Expenses, Child Credits, and Charitable Donations), being a W2 employee is the least efficient way to receive income. In the highest income brackets, $1 earned really only equals about 51 cents going to the bank (37% Fed + 5% State + 7.65% FICA = 49.65%). It’s easy to see why it’s easier to become financially free in the other quadrants of the Cash Flow Quadrant. There aren’t a lot of things an employee can do to reduce their taxes, except for investing outside of their employer’s retirement accounts (i.e. real estate and owning a business on the side).

The S Quadrant = Self Employed

Being self-employed is great and terrible, all at the same time. It’s great to be your own boss. It’s terrible (sometimes) because everything falls on you to make it happen. I applaud everyone who has a business idea and gives it a try. I think that’s the real American Dream.

Being self-employed has some additional advantages, from a tax perspective. Therefore, if you earn a $1 as a self-employed individual, you generally get to keep more of that dollar. The main reason is because, as a business owner, you get to write off many things that a strict W2 earner cannot. For example, as a business owner, I could write off my cell phone bill, my internet, vehicle expenses, a portion of my house (if I work from home), etc. Now, I will say that there are times when writing things off comes back to haunt people. When a person is trying to apply for a mortgage or disability insurance, having a lot of write-offs can hurt their ability to get approved for the loan they want or get approved for the amount of disability insurance coverage they might otherwise be able to qualify for. So, just keep that in mind. Sometimes, as a business owner, we choose not to write off something we otherwise could have, because we’re trying to qualify for those sorts of things. The IRS doesn’t force you to write off everything you legally can.

From a tax perspective, a self-employed person can reduce their taxes by having more write-offs, and they can reduce their FICA taxes, depending on the type of business entity they choose to file as. Business ownership can be as a Sole-Proprietor (in other words, an individual owns and runs the business, and they have no legal entity set up for it – this is the default business form), or LLC/PLLC/PC, S-Corporation, or C-Corporation. The most common business form is S-Corporation for serious small businesses. The reason is because, an S-Corporation allows the owner to pay himself/herself a wage (W2, which they typically minimize as much as possible – click here for information from the IRS on this topic), and then take the rest of the profit from the business as shareholder distributions, which are not subject to FICA taxes. This can be a huge difference (remember FICA is 15.3%) in the amount of tax a person could owe or keep.

People in the S-Quadrant are generally subject to “estimated taxes” and penalties associated with estimated taxes that should have been pre-paid throughout the year.

Example: Let’s say you owed $50,000 in Federal Income taxes last year, due to the taxable income you received from your business last year. The IRS expects you to pre-pay that same amount through the following year (usually through quarterly filing and payments). If you choose not to pre-pay the estimated taxes, you will owe a penalty on the amount the IRS says you should have paid. Side note: I often choose not to pre-pay the estimated tax because I can earn more by keeping the money in my use and control for the year and paying the tax and penalty on April 15th.

I think it’s important to note that the IRS has many codes related to taxes. Some are about how to pay taxes. Most are about how to avoid paying taxes, and most of those are directly related to owning a business. It’s also valuable to note that most millionaires in America create their wealth by:

a) owning a business, and/or

b) owning investment property.

The B Quadrant = Business Owner

How is this different than being in the S Quadrant? Being in the B Quadrant is being an owner of a business (either partially or fully) where the owner is not very (or at all) actively involved in the day-to-day operation of the business. They’ve Exited running the business. The business runs without them and pays them income whether they are there or not.

If the “officer” (owner) of the business is not actively involved, they are not required to pay themselves a wage. As such, there are no FICA taxes on profit distributions made to the owner of the business in this situation. Income/Profit can also be offset by depreciation of equipment/buildings, therefore making some of the income generated tax-free (this also applies to the S-Quadrant).

Dividends, which are profits from business ownership, are not subject to FICA or Self-Employment taxes (which are essentially FICA taxes). When the business is sold, the gains from the business are treated as Long-Term Capital Gains (if the business was owned more than five years, up to half of the gain may be excluded from taxable income and the other half could be taxed at 28% at the highest – compare that to 37%, which is the highest Ordinary Income tax rate).

The I Quadrant – Investor

Ultimately, if we could wave a magic wand and choose to have all our income come from this quadrant, we probably would. The taxation of the income from this quadrant is significantly lower than the others.

Interest and rent income are still taxed as Ordinary Income, but rent income, specifically, can be offset by depreciation of the rental property, making some or all the income tax-free. When investment assets are sold, if they are held for more than 12 months, the gains on the investments are taxed at most 20%. The current long-term capital gains tax rates are 0% (for married filing jointly who earn up to $94,050 per year), 15% (for married filing jointly who earn from $94,051 to $583,750), and 20% (for married filing jointly who earn over $583,750). FICA taxes and self-employment taxes do not apply to income generated in this quadrant. This quadrant is clearly the winner when it comes to lowering taxation.

Investments in this quadrant would include such things as stock ownership (both animal stock and business stock), businesses, real estate investments, bonds (the gains for selling the bonds, not the interest income generated from bonds), sale of partnerships, and so on.

Important Note: Investments that normally would receive Long-term capital gains treatment lose that treatment if they are placed into retirement accounts (self-directed IRAs, IRAs of any kind, 401(k)s, and so on). Additionally, if you lose money in these types of investments, the IRS lets you count those losses against earnings from other investments and even your earned income. However, if those same investments are placed in retirement accounts, they lose the privilege of counting losses against gains and other income.

Re-Characterizing Income/Earnings

It’s not super easy to simply re-characterize your income. However, there are likely things you can do, namely, you can control where you invest your money. Instead of investing in retirement accounts, which get taxed as Ordinary Income (except for Roth IRAs – which are also extremely limited on how much you can contribute to them) and lose any potential benefits from losses, you could invest outside of retirement accounts and hold the assets for more than a year.

As a business owner (in the S or B quadrant), if you are renting space from someone else, you could invest in property and pay yourself the rent instead. This essentially would re-characterize a portion of the income you would have received and likely would have been subject to FICA/Self-Employment taxes. By depreciating the building against the rental income, you could also take a good portion out tax-free for many years.

You could re-characterize your income by changing the taxation of your entity. For example, you could choose to have your LLC taxed as an S-Corporation (the S-Corporation filing election), and choose a low, but “reasonable wage” to pay yourself. This could significantly decrease your FICA/Self-Employment taxes, which means more money in your pocket.

You can choose to create your own insurance company for your business. The IRS understands that you can buy insurance for some aspects of your business, but not for others. For the other parts of the business you can’t buy insurance on, you could create your own insurance entity to insure those things. This can be called a Captive Insurance Company or a Private Re-Insurance Company (sometimes also called “831b”). If these insurance companies are properly structured, maintained, and funded, for the real purpose of being an insurance company for your business, they can be a way of re-characterizing business earned income/profit into long-term capital gains.

STRONG WARNING: The IRS doesn’t like when people play games with them or try to “outsmart them”. So, in general, when people set these insurance companies up for the sole purpose of really lowering their tax, they come under scrutiny, as well they should. I would urge “buyer beware” on this, but if done properly and for the real purpose of insurance on a business, it can be helpful. Here’s a link to an IRS News Release on this issue: https://www.irs.gov/newsroom/irs-urges-participants-of-abusive-micro-captive-insurance-arrangements-to-exit-from-arrangements

Next Month’s Email:

Part III of All of the Ways You Can Reduce Your Taxes: Increase Business Expenses