Why Is Whole Life Insurance A Great Option for Saving for My Kids’ Future?

Written by Kyle J Christensen, CFP, June 28, 2019 One of my fantastic clients asked me today about the idea of adding whole life insurance on kids. This was my response: My wife and I have whole life insurance on each of our kids, and there are several reasons for that. Here are some of […]

Debt and Opportunity Costs

Written by Kyle J Christensen, CFP, Aug. 14, 2020 The truth is, money is debt. Dollars are the only “legal tender” in the United States. In other words, dollars, which are a debt obligation (a promissory note) of the US government (printed by The Federal Reserve), is the only money in the United States. If a person wants […]

The True Cost of the Employer Match

Written by Kyle J Christensen, CFP, Sept. 27, 2019 When I asked clients why they are contributing to their company 401(k) they give me two answers usually, 1) they get a match, and 2) they save on taxes. Interestingly I’ve never heard anyone say that they are contributing to their 401(k) because they love the […]

Cash Flow Is King

Written by Kyle J Christensen, CFP, August 1, 2019 The Caspian Sea is the largest lake in the world. It is 640 miles long, and 270 miles wide at it’s widest. It is 6.7 times larger in volume than all of the Great Lakes in the Northern United States and Canada combined. To say it […]

How Can You Tell If You Are Gambling?

Written by Kyle J Christensen, CFP, April 12, 2021 I’ve had a lot of conversations lately with clients about the difference between gambling and investing. Many of my clients have seen others (even some of my clients) make a lot of money “investing” in Bitcoin and other cryptocurrencies. The ones who haven’t “invested” in Bitcoin […]

The Value of Principles

Written by Kyle J Christensen, CFP, Oct. 25, 2022 One of the treasured few memories I have with my maternal grandfather is of he and me sitting together, watching the stars at night. Because he lived in a small rural town in northern Utah, the stars were nice and bright. We especially valued the moments […]

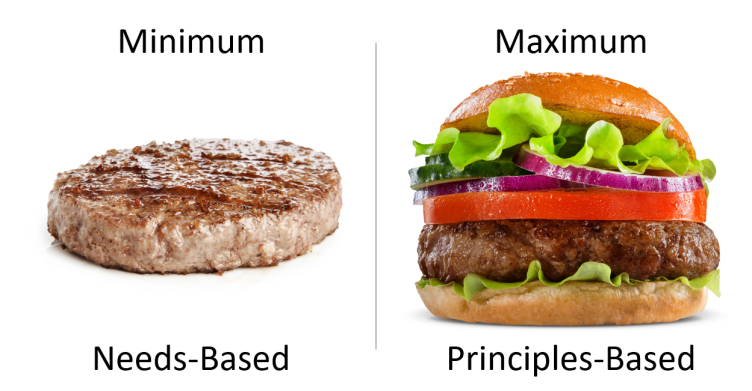

Needs Planning Is Minimum Planning

Written by Kyle J Christensen, CFP, March 4, 2022 By definition, need means being in “a condition requiring supply or relief.” It means “lack of the means of subsistence; Poverty”. I don’t know about you, but as someone who does financial planning for a living, that’s an alarming definition, especially when you realize the majority of the […]

When People Say They Already Have a Financial Advisor…

Written by Kyle J Christensen, CFP, April 5, 2023 As a financial planner who continues to grow my clientele, I run into this response from a surprising number of people, even though statistically, in the United States, only 35% of Americans report having worked with a financial advisor (see statistics from statista.com or motleyfool.com). I […]

BAD COMPARISONS: Which is better? Term or Whole Life?

Written by Kyle J Christensen, March 16, 2022 Which screwdriver is better? That’s all I hear when insurance agents and securities reps argue about which type of life insurance is “the best,” with the focus almost solely on the premium and/or the “rate of return”. “Which type of life insurance is better?” is really not […]

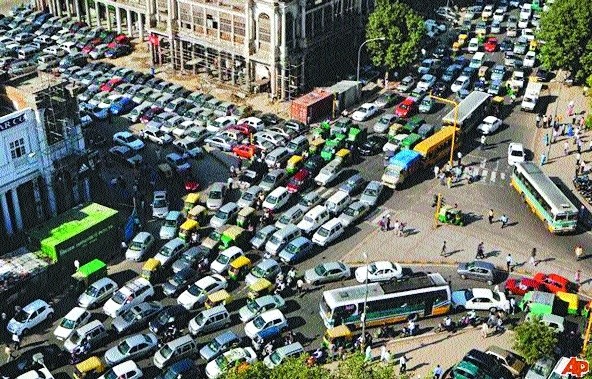

Social Proof and Your Money

Written by Kyle J Christensen, CFP, March 21, 2023 Let’s face the truth. We are creatures that like to be in a herd. No! I’m not saying we love big lines at amusement parks or to get into the restroom, but all-in-all, we seek the comfort of knowing that we’re doing “what everyone else is doing”. Or at least, […]

Inflation and the Impact It Has On Your Protection

Written by Kyle J Christensen, CFP, Nov. 9, 2022 Inflation has been one of the top concerns on people’s minds lately, as well it should be. How does inflation affect us financially? Most people can easily see how inflation impacts the dollars in their wallets. They are worth less. I’ve heard estimates that inflation has basically taken away about […]

Specialization, Not Diversification

Written by Kyle J Christensen, CFP, May 8, 2023 We are often told by financial institutions, that we should “diversify” our investments. Supposedly, this is how a person can reduce their risk of having a major loss when the economy goes through a downturn, a recession, or even a depression. And because most people are generally risk-averse […]